UNITED STATES

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registrant þ Filed by a Party other than the Registrant ¨

Check the appropriate box:

| Filed by the Registrant |  | Filed by a Party other than the Registrant |

| Check the appropriate box: | ||

| Preliminary Proxy Statement | |

| ||

| Confidential, for Use of the Commission Only (as permitted by Rule | ||

| ||

| Definitive Proxy Statement | ||

| ||

| Definitive Additional Materials | ||

| ||

| Soliciting Material | ||

LyondellBasell Industries N.V.

(Name of Registrant as Specified Inin Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| Payment of Filing Fee (Check all boxes that apply): | |||||

| No fee required. | ||||

| Fee paid previously with preliminary materials. | ||||

| Fee computed on table | ||||

April 8, 2024 On behalf of the Board of Directors of LyondellBasell Industries N.V. (“LYB” or the “Company”), we are pleased to present our 2024 proxy statement. DELIVERING STRONG FINANCIAL RESULTS In 2023, LYB delivered resilient financial results amid challenging market conditions. We generated $4.9 billion in cash from operating activities and returned $1.8 billion to our shareholders through dividends and share repurchases, extending our track record of outstanding cash generation and strong returns. IMPLEMENTING OUR NEW STRATEGY TO GROW SUSTAINABLE VALUE Last year, we launched our three-pillar strategy to create a more profitable and sustainable growth engine for LYB. Our strategy focuses on three key initiatives: •Growing and upgrading the core; •Building a profitable Circular and Low Carbon Solutions (“CLCS”) business; and •Stepping up performance and culture. One year after launch, we are making significant progress on each pillar. In March 2023, we successfully started up the world’s largest propylene oxide (PO) and tertiary butyl alcohol (TBA) unit in Texas, which enables us to meet the growing demand for essential products. In early 2024 we entered into an agreement for a new propylene and polypropylene joint venture in Saudi Arabia. This year, we will continue to focus on efficiently growing and upgrading our core and expect to close the sale of our ethylene oxide and derivatives business. Following our final investment decision in 2023, we will also move forward on engineering and construction of our first advanced recycling plant using LYB’s proprietary MoReTec technology. Throughout the year, our CLCS business built strong foundations to secure feedstock supply, expand our recycling footprint, and develop scalable recycling technologies to support the reduction of plastic waste in the environment. In addition, we formed joint ventures to build plastics recycling infrastructure in Europe, Asia, and North America. We also achieved nearly 90% of our goal to procure half of our electricity from renewable sources and issued our inaugural green bond to help advance LYB’s long-term sustainability goals. We are stepping up performance and culture with our Value Enhancement Program (VEP), which helped us double our original target for recurring annual EBITDA in 2023. Our new brand identity, revealed in October 2023, visually expresses our commitment and alignment to our strategy and purpose. Amid these big changes, we remain committed to our GoalZERO safety culture. In 2023, we extended our industry-leading safety record with a total recordable incident rate of 0.139 and a process safety incident rate of 0.035. We are proud that 60 of our manufacturing sites achieved GoalZERO, and 67 manufacturing sites were injury-free. ELECTING A DIVERSE AND QUALIFIED BOARD The Board is pleased to introduce our new director nominee, Bridget Karlin, the Senior Vice President of Information Technology, Services & Operations, at Kaiser Permanente, one of the largest not-for-profit health care systems in the U.S. Ms. Karlin brings over 30 years of experience in enterprise-wide digital technology to our Board. If each of our nominees is elected, four of our twelve directors will be women and fifty percent of our Board will be gender, ethnically, or racially diverse. SHAREHOLDER VOTING Your vote is important, and we encourage you to cast your vote as soon as possible to ensure your shares are represented at the meeting. Thank you for your investment in LYB. |

$4.9B

CASH FROM $1.8B RETURNED TO

| ||

| JACQUES AIGRAIN Chair of the Board | PETER VANACKER CEO | ||

|  | ||

| 2024Proxy Statement | LyondellBasell | 3 |

We are LyondellBasell – a leader in the global chemical industry creating solutions for everyday sustainable living. Through advanced technology and focused investments, we are enabling a circular and low carbon economy.

Across all we do, we aim to unlock value for our customers, investors and society. As one of the world’s largest producers of polymers and a leader in polyolefin technologies, we develop, manufacture and market high-quality and innovative products for applications ranging from sustainable transportation and food safety to clean water and quality healthcare.

Creating solutions for everyday sustainable living

Our Values

Our values provide grounding in behaviors that ensure our team is achieving company objectives through a shared, unifying culture of

We champion people | ||||

We strive for excellence We shape the future | Our Commitments

We’re committed to

| |||

| ||||

| ||||

As an inventor and | ||||

| ||||

| ||||

| ||||

Impactful collaboration | ||||

NOTICE OF AND AGENDA FOR

2016 ANNUAL GENERAL MEETING OF SHAREHOLDERS

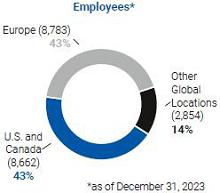

100+ countries where our | 20 countries with manufacturing | ~6,200 patents and patent | ~20,300 employees globally | ||||||||

#1 largest producer of | #1 largest producer of | #2 largest producer of | #2 largest producer of | ||||||||

| 2024Proxy Statement | LyondellBasell | 4 |

| MEETING INFORMATION | |

| FRIDAY, MAY 24, 2024 8:00 a.m. | SHERATON HOTEL Schiphol Airport, 1118 BG, Amsterdam, the Netherlands |

|

| |

| 1. | Elect our Board of Directors; |

| 2. | Discharge our

|

| 3. | Adopt our 2023 Dutch statutory annual accounts; |

| 4. | Appoint the

|

| 5. | Ratify the appointment of

|

| 6. | Provide an advisory vote on our executive

|

| 7. | Authorize the repurchase of up to 10% of our

|

| 8. | Approve the |

We will also discuss our corporate governance, dividend policy, and executive compensation program.

By order of the Board,

CHARITY R. KOHL

Corporate Secretary

April 8, 2024

| Your vote is important. You | |||||

|  |  |  |  | ||

| ONLINE Visit the website on your proxy card | BY MOBILE DEVICE Scan this QR code to vote with your mobile device | BY PHONE Call the telephone number on your proxy card | BY MAIL Sign, date and return your proxy card in the enclosed envelope | IN PERSON Attend the annual meeting in person. See page 93 | ||

| Important Notice Regarding Availability of Proxy Materials for the 2024 Annual General Meeting This proxy statement and our 2023 annual report to shareholders are available on our website at | |||||

| ||

| 2024Proxy Statement | LyondellBasell | 5 | ||

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS The statements in this proxy statement relating to matters that are not historical facts are forward-looking statements. These forward-looking statements are based upon assumptions of management of LYB which are believed to be reasonable at the time made and are subject to significant risks and uncertainties. When used in this proxy statement, the words “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “expect,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Actual results could differ materially based on factors including, but not limited to, our ability to attract and retain a highly skilled and diverse workforce; actions taken by customers, suppliers, regulators, and others in response to increasing concerns about the environmental impact of plastic in the environment or other general sustainability initiatives; our ability to meet our sustainability goals, including the ability to operate safely, increase production of recycled and renewable-based polymers to meet our targets and forecasts, and reduce our emissions and achieve net zero emissions by the time set in our goals; our ability to procure energy from renewable sources; our ability to build a profitable Circular and Low Carbon Solutions business; our ability to successfully implement initiatives identified pursuant to our Value Enhancement Program and generate anticipated earnings; water scarcity and quality; the pace of climate change and legal or regulatory responses thereto; and technological developments, and our ability to develop new products and process technologies. Additional factors that could cause results to differ materially from those described in the forward-looking statements can be found in the “Risk Factors” sections of our Form 10-K for the year ended December 31, 2023, which can be found at www.LyondellBasell.com on the Investor Relations page and on the Securities and Exchange Commission’s website at www.sec.gov. There is no assurance that any of the actions, events or results of the forward-looking statements will occur, or if any of them do, what impact they will have on our results of operations or financial condition. Forward-looking statements speak only as of the date they were made and are based on the estimates and opinions of management of LYB at the time the statements are made. LYB does not assume any obligation to update forward-looking statements should circumstances or management’s estimates or opinions change, except as required by law. References to our website in this proxy statement are provided as a convenience, and the information on our website is not, and shall not be deemed to be a part of this proxy statement or incorporated into any other filings we make with the Securities and Exchange Commission. |

| 2024Proxy | LyondellBasell | 6 |

This summary highlights information contained elsewhere in this proxy statement. The summary does not include all of the information you should consider before voting your shares, and we encourage you to read the full proxy statement carefully.

Date and Time Friday, May 24, 2024, | Place Sheraton Hotel, Schiphol Airport | Record Date Friday, April 26, 2024 |

| Item | Board Recommendation | Page | |||||

| 1 | Election of 12 directors |  | FOR all nominees | 10 | |||

| 2 | Discharge of directors from liability |  | FOR | 40 | |||

| 3 | Adoption of Dutch statutory annual accounts |  | FOR | 40 | |||

| 4 | Appointment of auditor of Dutch statutory annual accounts |  | FOR | 41 | |||

| 5 | Ratification of independent registered public accounting firm |  | FOR | 41 | |||

| 6 | Advisory vote on executive compensation (say-on-pay) |  | FOR | 44 | |||

| 7 | Authorization to conduct share repurchases |  | FOR | 84 | |||

| 8 | Cancellation of shares |  | FOR | 85 | |||

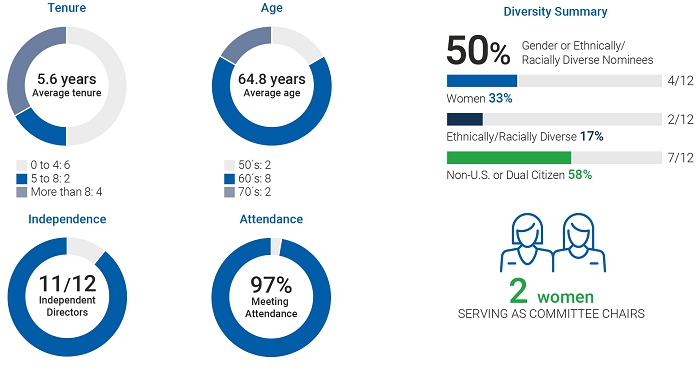

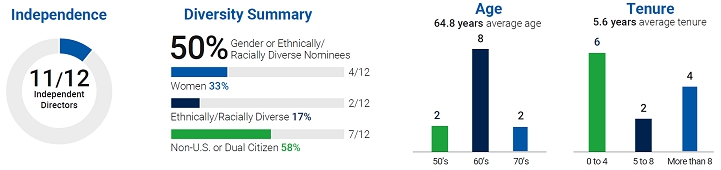

| Annual election of directors |  | Board diversity (4 female director nominees and 2 ethnically/racially diverse director nominees) | |

| Independent Board (11 of 12 director nominees) |  | Code of Conduct supported by whistleblower helpline and robust compliance program | |

| Independent Committees (100% of directors on each Board Committee are independent) |  | Board engagement on strategy, long range planning, and capital allocation | |

| Independent Board Chair |  | Board oversight of enterprise risk management and sustainability strategy | |

| Executive sessions at each regularly scheduled Board and Committee meeting |  | Regular succession planning for directors and executive management with focus on talent development | |

| Annual self-assessments for the Board and each Committee |  | High director attendance and engagement, with average meeting attendance of 97% in 2023 | |

| Board refreshment supported by mandatory retirement age and annual Board self-assessments |  | Stock ownership guidelines for directors and executives and policy against hedging and pledging the Company’s shares |

| 2024Proxy Statement | LyondellBasell | 7 |

All Committee memberships shown in the table below will be effective following the 2024 annual general meeting, including Ms. Karlin’s Committee memberships. For more information about our 2023 Committee membership, see “Board and Committee Information” on page 33.

| Nominee | Age | Years of Service | Independent | Committee Memberships | Other Public Boards | ||||||||

| Audit | C&TD | NomGov | HSE&S | Finance | |||||||||

| Jacques Aigrain | 69 | 13 | YES |  |  |  | 2 | ||||||

| Lincoln Benet | 60 | 9 | YES |  |  | 1 | |||||||

| Robin Buchanan | 72 | 13 | YES |  |  | 0 | |||||||

| Anthony (Tony) Chase | 69 | 3 | YES |  |  | 3 | |||||||

| Robert (Bob) Dudley | 68 | 3 | YES |  |  | 1 | |||||||

| Claire Farley | 65 | 10 | YES |  |  | 2 | |||||||

| Rita Griffin | 61 | 1 | YES |  |  | 0 | |||||||

| Michael (Mike) Hanley | 58 | 6 | YES |  |  | 1 | |||||||

| Virginia (Ginny) Kamsky | 70 | 2 | YES |  |  | 1 | |||||||

| Bridget Karlin | 67 | Nominee | YES |  |  | 1 | |||||||

| Albert Manifold | 61 | 5 | YES |  |  | 1 | |||||||

| Peter Vanacker | 58 | 2 | CEO | 1 | |||||||||

Chair Chair |  Member Member | ||||||||||||

| 2024Proxy Statement | LyondellBasell | 8 |

In 2023, LYB delivered resilient results and outstanding cash conversion. Despite economic uncertainty and pressure from new industry capacity and softer global demand, our businesses efficiently generated cash from a diverse business portfolio. We remain committed to a disciplined approach to capital allocation while advancing long-term strategies that capture value and accelerate sustainable growth.

| $2.1B | $5.2B | $1.8B |

| Net Income | EBITDA Ex. Identified Items* | Returned To Shareholders |

| * | See Appendix A for information about our non-GAAP financial measures and a reconciliation of net income to EBITDA, including and excluding identified items. Identified items include adjustments for impairments and refinery exit costs. |

| CASH GENERATION | Achieved robust cash generation driven by diverse business portfolio |  | STRONG BALANCE SHEET | Maintained a strong, investment-grade balance sheet and ample liquidity | |||

| SAFETY | Continued to focus on safe operations and emphasize our GoalZERO program |  | SHAREHOLDER RETURNS | Delivered 13th consecutive year of regular dividend growth | |||

| COST DISCIPLINE | Committed to balanced and disciplined capital allocation to enhance value and growth |  | SUSTAINABILITY | Established our Green Financing Framework and issued inaugural green bond | |||

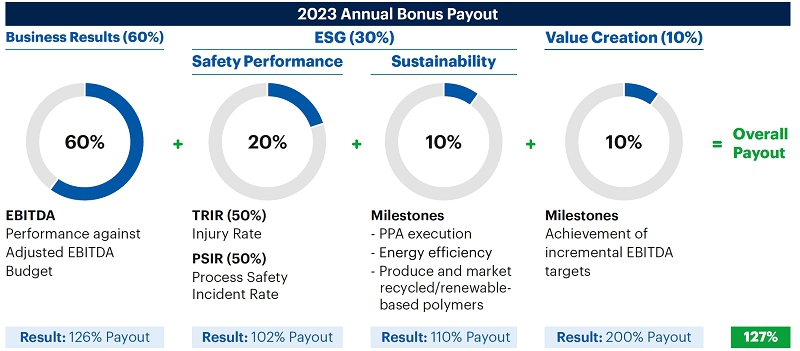

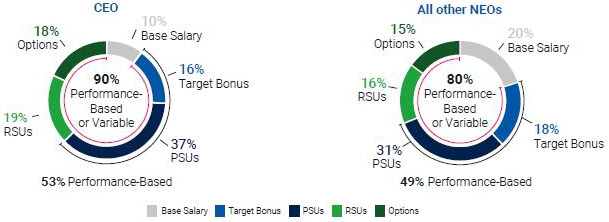

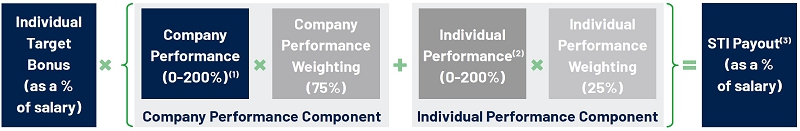

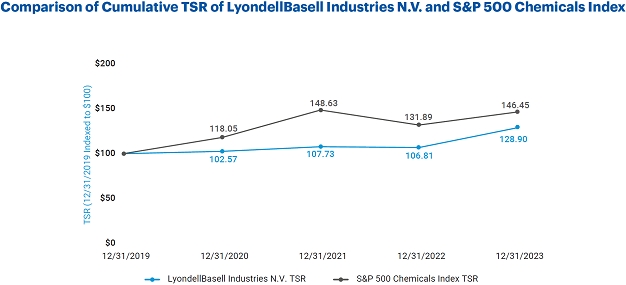

We are committed to a pay for performance philosophy, and our compensation programs align executive and shareholder interests by tying a significant amount of compensation to our financial, business, and strategic goals. Our Compensation and Talent Development (“C&TD”) Committee continually monitors compensation best practices, the effectiveness of our compensation programs, and their alignment with our compensation philosophy. In 2023, challenging market conditions impacted EBITDA, but our strong performance on the environmental, social and governance (ESG) metrics and achievement of milestones under our Value Enhancement Program resulted in annual bonuses paying slightly above target. Our performance share units (“PSUs”) granted in 2021 under our long-term incentive program, with a three-year performance period ended December 31, 2023, earned 200% of target, reflecting the fact that our total shareholder returns (“TSR”) fell in the top quartile of selected peers and our and free cash flow (“FCF”) per share exceeded targets set by our C&TD Committee. For more information on our annual bonus performance metrics, see “2023 Executive Compensation Decisions in Detail” on page 53.

| 2024Proxy Statement | LyondellBasell | 9 |

| The Board recommends that you vote FOR the election of each of the nominees to our Board of Directors. |

The Board of Directors of LYB recommends that each of the twelve director nominees introduced below be elected to our Board, in each case for a term ending at our 2025 annual general meeting of shareholders. The nominees include eleven current directors, who were elected by shareholders at the 2023 annual general meeting, and new director candidate Bridget Karlin.

Our goal is to have a Board that provides effective oversight of the Company through the appropriate balance of experience, expertise, skills, competencies, specialized knowledge, and other qualifications and attributes. Director candidates also must be willing and able to devote the time and attention necessary to engage in relevant, informed discussion and decision-making. Our Nominating and Governance Committee focuses on Board succession planning and refreshment and is responsible for recruiting and recommending nominees to the full Board for election. The Committee considers the qualifications, contributions, and outside commitments of each current director, as well as the results of annual Board self-assessments and management assessments, in determining whether he or she should be nominated for reelection. Many of our directors serve on the boards and board committees of other companies, and the Committee believes this service provides additional experience and knowledge that improve the functioning of our own Board. Our Board Profile, which is available on our website, provides general principles for the composition, expertise, background, diversity and independence of the Board and guides our Nominating and Governance Committee on the nomination and appointment of directors.

Our Board considers diversity a priority and seeks representation across a range of attributes, including race, gender, ethnicity, and nationality. In accordance with our Corporate Governance Guidelines, the Committee and any outside search firms engaged to assist in identifying potential director candidates include women and candidates from underrepresented populations in each pool from which a director candidate is selected. These recruitment efforts are evidenced by our current Board composition and the qualities and qualifications of our nominees. If each of our twelve director nominees for 2024 is elected, we will meet our goal of appointing at least one-third female directors.

Our director nominees provide the Board with a broad range of perspectives due to their diverse gender, race, ethnicity, nationality, age, and tenure profiles, as well as the qualifications and skills identified below. Each of the eleven non-executive directors nominated to our Board is independent, and 50% of our director nominees are gender, ethnically or racially diverse. This section provides information on our director nominees for the 2024 annual general meeting. For more information about our current Board as of the date of this proxy statement, see “Board and Committee Information” on page 33.

| 2024Proxy Statement | LyondellBasell | 10 |

| DIRECTOR EXPERIENCE AND EXPERTISE |  |  |  |  |  |  |  |  |  |  |  |  | |||

| INDUSTRY EXPERIENCE Experience with and understanding of the chemicals and refining industries |  |  |  |  |  | |||||||||

|

Experience with social responsibility issues related to health, safety, and the environment |  |  |  |  |  |  |  |  | ||||||

| Corporate strategy and strategic planning experience |  |  |  |  |  |  |  |  |  |  |  |  | ||

| MERGERS & ACQUISITIONS Experience with mergers, acquisitions, and other strategic transactions |  |  |  |  |  |  |  |  |  |  |  | |||

| CORPORATE FINANCE Financial expertise and experience with corporate finance |  |  |  |  |  |  |  |  |  |  | ||||

| EXECUTIVE MANAGEMENT / CEO EXPERIENCE Executive management experience with large or international organizations |  |  |  |  |  |  |  |  |  |  |  |  | ||

| CORPORATE GOVERNANCE Knowledge of |  |  |  |  |  |  |  |  |  |  |  |  | ||

| RISK MANAGEMENT Experience identifying, managing, and mitigating key enterprise risks |  |  |  |  |  |  |  |  |  |  |  |  | ||

| PUBLIC COMPANY DIRECTOR Service on the boards of other public companies |  |  |  |  |  |  |  |  |  |  |  |  | ||

| HUMAN CAPITAL MANAGEMENT Experience and expertise related to human resources, talent, diversity, and culture |  |  |  |  |  |  |  |  |  |  |  | |||

|

Experience with cybersecurity systems and |  |  | ||||||||||||

|

Experience with technology-related business or emerging technology trends |  |  |  |  |  |  |  | |||||||

| PUBLIC POLICY AND COMPLIANCE Government relations, legal, regulatory compliance and/or public policy experience |  |  |  |  |  |  |  | |||||||

| DIVERSITY AND DEMOGRAPHICS | |||||||||||||||

| Race/Ethnicity | |||||||||||||||

| African American or Black |  | ||||||||||||||

| Alaskan Native or American Indian | |||||||||||||||

| Asian | |||||||||||||||

| Caucasian or White |  |  |  |  |  |  |  |  |  |  | |||||

| Hispanic or Latino |  | ||||||||||||||

| Native Hawaiian or Pacific Islander | |||||||||||||||

| Gender | |||||||||||||||

| Male |  |  |  |  |  |  |  |  | |||||||

| Female |  |  |  |  | |||||||||||

| 2024Proxy Statement | LyondellBasell | 11 |

The Board is responsible for nominating candidates for Board membership, and our Nominating and Governance Committee is responsible for recommending director candidates to the Board. Potential candidates may also be recommended to the Nominating and Governance Committee for consideration by other directors, management, and our shareholders. From time to time, the Committee works with outside search firms to assist with identifying and evaluating director candidates. A shareholder who wishes to recommend a director candidate should submit a written recommendation to our Corporate Secretary by email or regular mail. The recommendation must include the name of the nominated individual, relevant biographical information, and the individual’s consent to be nominated and to serve if elected. The Corporate Secretary may request additional information to assist the Nominating and Governance Committee in its evaluation. Our Nominating and Governance Committee uses the same process to evaluate shareholder nominees as it does in evaluating nominees identified by other sources. For our 2025 annual general meeting of shareholders, recommendations must be received by December 9, 2024 to be considered. |

BY EMAIL send an email to | |

BY MAIL LyondellBasell Industries N.V. |

On the recommendation of the Nominating and Governance Committee, the Board has nominated each of the eleven directors elected by shareholders at our 2023 annual general meeting and one new director nominee, Bridget Karlin. In evaluating these nominees, the Nominating and Governance Committee considered the Board’s 2023 director self-assessments and management evaluations, as well as each nominee’s background and skill set. These twelve individuals have a diverse array of expertise, experience, and leadership skills that support the Company’s strategy evolution. Each nominee has consented to serve as a director if elected.

We introduce our twelve nominees below. All Committee memberships shown in this section will be effective following the 2024 annual general meeting. For more information about our current Board and Committee membership as of the date of this proxy statement, see “Board and Committee Information” on page 33.

| 2024Proxy Statement | LyondellBasell | 12 |

| Jacques Aigrain, 69 French-Swiss Non-Executive Director since 2011; INDEPENDENT Committees • Audit Committee • Nominating and Governance Committee • Finance Committee |

Biography Mr. Aigrain is our Chair of the Board and a retired Senior Advisor and Partner of Warburg Pincus, a global private equity firm. Prior to joining Warburg Pincus in 2013, Mr. Aigrain spent nine years at SwissRe AG, a publicly traded insurance company, including as Chief Executive Officer, and 20 years in global leadership roles at J.P. Morgan in New York, London and Paris. He also has many years of experience as a director of public and multinational organizations, including The London Stock Exchange Group plc, WPP plc, a multinational advertising and public relations company, and currently, Clearwater Analytics Holdings Inc., a maker of financial software products, and TradeWeb Markets Inc., an international financial services company. He holds a doctorate in economics from Université Paris-Sorbonne and a master’s in economics from Université Paris Dauphine – PSL. Mr. Aigrain’s more than 30 years of financial services and management background, including extensive executive and board experience, provide him with expertise in strategy development and implementation, mergers and acquisitions, finance, and capital markets. Additionally, he brings substantial knowledge of board and governance matters to the Board. | ||||

| Skills And Qualifications | ||||

• Corporate Finance • Risk Management • Mergers & Acquisitions • International Operations | • Corporate Governance • Corporate Strategy • Capital Markets | • CEO Experience • Public Company Director • Public Policy and Compliance | ||

Other Current Public Directorships • Clearwater Analytics Holdings Inc. (since 2021) • TradeWeb Markets Inc. (since 2022) Former Public Directorships • The London Stock Exchange Group plc (2013-2022) • WPP plc (2013-2022) | ||||

| Lincoln Benet, 60 American-British Non-Executive Director since 2015 INDEPENDENT Committees • Nominating and Governance Committee • Finance Committee (Chair) |

Biography Mr. Benet has served as Chief Executive Officer of Access Industries, a privately held industrial group with world-wide holdings, since 2006. Prior to joining Access, he spent 17 years at Morgan Stanley, including as Managing Director. Mr. Benet also has experience serving on the boards of several privately held and publicly traded companies, including those in the investment, music and publishing, oil and gas pipes and tubing, cement, sports media, and petrochemicals industries. As a result of this background, he brings to our Board a working knowledge of global markets, mergers and acquisitions, executive management, strategic planning, and corporate strategy, as well as extensive experience with international finance and corporate finance matters, including treasury, insurance, and tax. Mr. Benet received his M.B.A. from Harvard Business School and his B.A. in Economics from Yale University. Mr. Benet possesses significant experience advising and managing publicly traded and privately held enterprises and brings substantial knowledge of corporate finance and strategic business planning activities to the Board. | ||||

| Skills And Qualifications | ||||

• Corporate Strategy • Mergers & Acquisitions • International Operations • Human Capital Management | • Corporate Governance • Corporate Finance • Risk Management • Technology and Innovation | • Capital Markets • CEO Experience • Public Company Director • Public Policy and Compliance | ||

Other Current Public Directorships • Warner Music Group Corp. (since 2011; public since 2020) | ||||

| 2024Proxy Statement | LyondellBasell | 13 |

| Robin Buchanan, 72 British Non-Executive Director since 2011 INDEPENDENT Committees • Health, Safety, Environmental, and Sustainability (“HSE&S”) Committee • Nominating and Governance Committee |

Biography Mr. Buchanan has previously served as Dean and President of London Business School, the Chairman of PageGroup plc, a global specialist recruitment company, a director of Schroders plc, a global asset management firm, a director of Cicap Ltd, a global private equity firm, and a director of Bain & Company Inc., a global business consulting firm. As the former Managing Partner of Bain in the UK and Senior Partner for the UK and South Africa, he continues to serve in an advisory role to Bain. Until August 2023, Mr. Buchanan also served as an advisor to Access Industries and Non-Executive Chairman of its Advisory Board. Mr. Buchanan’s experience as a board member of publicly traded, private, and charitable companies, Dean of a leading Business School, and long tenure with Bain provide him with deep experience in strategy, leadership, board effectiveness, business development, and acquisitions across most industry sectors, including considerable involvement with chemicals and energy in Europe. He also brings a wealth of experience in board and governance matters, particularly as related to multi-national companies. Mr. Buchanan is a Chartered Accountant and a published author on strategy, acquisitions, leadership, board effectiveness, corporate governance, and compensation. Mr. Buchanan received his FCA from the Institute of Chartered Accountants in England & Wales and his M.B.A. with High Distinction from Harvard Business School. | ||||

| Skills And Qualifications | ||||

• Industry Experience • Corporate Strategy • Mergers & Acquisitions • Corporate Finance • Corporate Accounting | • International Operations • Leadership Development • Executive Management • Risk Management • Corporate Governance | • Public Company Director • Human Capital Management • Technology and Innovation • Public Policy and Compliance | ||

Former Public Directorships • Schroders plc (2010-2019) | ||||

| Anthony (Tony) Chase, 69 American Non-Executive Director since 2021 INDEPENDENT Committees • Audit Committee • C&TD Committee |

Biography Mr. Chase is the Chairman and Chief Executive Officer of ChaseSource, L.P., a staffing, facilities management, and real estate development firm founded by him in 2006 and recognized as one of the nation’s largest minority-owned businesses by Black Enterprise Magazine. Prior to ChaseSource, Mr. Chase founded and sold three successful ventures: Chase Radio Partners, Cricket Wireless and ChaseCom. He is also a principal owner of the Marriott Hotel at George Bush Intercontinental Airport in Houston and the Principle Toyota dealership in greater Memphis. He currently serves as a director of Cullen/Frost Bankers, Inc., a financial holding company, Nabors Industries, an operator of drilling rig fleets and provider of offshore platform rigs, and Par Pacific Holdings, Inc., an oil and gas exploration and production company. Mr. Chase is a Professor of Law Emeritus at the University of Houston Law Center, a member of the Council on Foreign Relations, and serves on the board of numerous Houston-based non-profits including the Houston Endowment, the Greater Houston Partnership, the Greater Houston Community Foundation, the M.D. Anderson Board of Visitors, and the Texas Medical Center. He previously served as Deputy Chairman of the Federal Reserve Bank of Dallas. Mr. Chase is an honors graduate of Harvard College, Harvard Law School and Harvard Business School. He has received many awards, including the American Jewish Committee’s 2016 Human Relations Award, Houston Technology Center’s 2015 Entrepreneur of the Year, NAACP 2013 Mickey Leland Humanitarian Award, GHP 2013 Bob Onstead Leadership Award, the 2012 Whitney M. Young Jr. Service Award, Ernst & Young’s Entrepreneur of the Year Award, Bank of America’s Pinnacle Award and UH Law Center’s Baker Faculty Award. | ||||

| Skills And Qualifications | ||||

• CEO Experience • Risk Management • Mergers & Acquisitions | • HSE Experience • Strategic Planning • Corporate Governance | • Corporate Finance • Public Company Director • Human Capital Management | ||

Other Current Public Directorships • Nabors Industries Ltd. (since 2019) • Cullen/Frost Bankers, Inc. (since 2020) • Par Pacific Holdings, Inc. (since 2021) Former Public Directorships • Anadarko Petroleum Corp. (2014-2019) • Paragon Offshore plc (2014-2017) • Heritage-Crystal Clean, Inc. (2020-2022) | ||||

| 2024Proxy Statement | LyondellBasell | 14 |

| Robert (Bob) Dudley, 68 American-British Non-Executive Director since 2021 INDEPENDENT Committees • Finance Committee • HSE&S Committee |

Biography Mr. Dudley is Chairman of the international industry-led Oil and Gas Climate Initiative, which aims to accelerate the oil and gas industry’s response to climate change, and Chair of the Accenture Global Energy Board. He served as the Group Chief Executive of BP plc, a global energy provider, from 2010 to 2020. He was appointed to the board of BP in 2009, and previous executive roles with BP include Alternative and Renewable Energy activities and responsibility for BP’s upstream business in Russia, the Caspian region, and Africa. Mr. Dudley is a Fellow of the Royal Academy of Engineering, and received an M.B.A. from Southern Methodist University and a B.S. in Chemical Engineering from the University of Illinois. As the former CEO of a multinational oil and gas company, he has acquired extensive executive management experience and knowledge of the energy industry, including a leadership role in advancing decarbonization plans and other key sustainability initiatives. He also serves as chairman of the board of Axio, a leading SaaS provider of cyber risk management and quantification solutions, and director of 8 Rivers Capital LLC, a private firm leading the invention and commercialization of technologies for the global energy transition. Mr. Dudley has over 40 years of experience in strategic planning, risk management (including risks related to climate change), international operations, and health, safety, environmental and operational matters. | ||||

| Skills And Qualifications | ||||

• Risk Management • HSE Experience • Industry Experience | • Public Company Director • Climate Expertise • Corporate Strategy • International Operations | • Mergers & Acquisitions • Human Capital Management • Corporate Governance • Technology and Innovation | ||

Other Current Public Directorships • Freeport-McMoRan Inc. (since 2021) Former Public Directorships • Rosneft Oil Company (2013-2022) • BP plc (2009-2020) | ||||

| Claire Farley, 65 American Non-Executive Director since 2014 INDEPENDENT Committees • Audit Committee • Nominating and Governance Committee (Chair) |

Biography Ms. Farley was a partner at KKR Management, LLC, a global investment firm, from 2013 until her retirement in 2016, and subsequently served as Vice Chair of the | ||||

| Skills And Qualifications | ||||

• CEO Experience • Corporate Strategy • Risk Management • Human Capital Management | • Public Company Director • Capital Markets • Corporate Governance | • Corporate Finance • Mergers & Acquisitions • International Operations | ||

Other Current Public Directorships • TechnipFMC plc (since 2017) • Crescent Energy Company (since 2021) Former Public Directorships • Anadarko Petroleum Corporation (2017-2019) | ||||

| 2024Proxy Statement | LyondellBasell | 15 |

| Rita Griffin, 61 American Non-Executive Director since 2023 INDEPENDENT Committees • C&TD Committee • HSE&S Committee (Chair) |

Biography Ms. Griffin served as the Chief Operating Officer of Global Petrochemicals at BP plc, one of three main divisions of BP’s downstream business, from 2015 to 2020. Previously, she served in a number of leadership positions within BP plc’s manufacturing, logistics, retail and functional organizations. Ms. Griffin began her career at Amoco and Standard Oil (Indiana), which was acquired by BP plc in 1998. She is a Certified Public Accountant and Certified Managerial Accountant, and received her master of management from Northwestern University and bachelor of business administration in accounting from Northern Illinois University. With over 30 years of experience in global oil and gas and chemicals businesses, Ms. Griffin has considerable experience in developing and implementing strategies and leading substantial transformation programs. She has previously served on the board of directors of Royal Mail Group PLC, an international postal service and courier company, where she provided oversight for environment strategy and implementation, health, safety and security, ethics and compliance, culture and employee engagement, diversity and inclusion, governance and community stakeholder engagement, and customer satisfaction. | ||||

| Skills And Qualifications | ||||

• Industry Experience • HSE Experience • Capital Project Execution • Mergers & Acquisitions | • Public Company Director • International Operations • Corporate Strategy • Risk Management | • Executive Management • Corporate Finance • Corporate Governance • Human Capital Management | ||

Former Public Directorships • Royal Mail Group PLC (2016-2022) | ||||

| Michael (Mike) Hanley, 58 Canadian Non-Executive Director since 2018 INDEPENDENT Committees • Audit Committee (Chair) • Finance Committee |

Biography Mr. Hanley has more than 30 years of experience in senior management and finance roles, including as Chief Financial Officer of Alcan, a Canadian mining company and aluminum manufacturer, President and CEO of Alcan’s Global Bauxite and Alumina business group, and Senior Vice President, Operations & Strategy of the National Bank of Canada. He brings strong financial and operational experience, deep knowledge of capital-intensive and process industries, experience with U.S. and international accounting standards, and a broad understanding of international markets. Mr. Hanley also has significant experience on public company boards, including in the roles of lead director, chair of the board, and audit committee chair, and has an appreciation for corporate governance matters and the board’s role in financial oversight. He currently serves as chair of the board of EQB Inc., which provides personal and commercial banking services, and previously served as lead director and audit committee chair of Nuvei Corporation and BRP Inc. He is also a member of the Quebec Order of Chartered Professional Accountants. Mr. Hanley received his bachelor of business administration from HEC Montreal. | ||||

| Skills And Qualifications | ||||

• Corporate Finance • Corporate Strategy • Risk Management • International Operations • Public Company Director | • Corporate Accounting • Capital Markets • HSE Experience • Mergers and Acquisitions • Executive Management | • Corporate Governance • Human Capital Management • Technology and Innovation • Public Policy and Compliance | ||

Other Current Public Directorships • EQB Inc. (since 2022) Former Public Directorships • Nuvei Corporation (2020-2023) • BRP, Inc. (2012-2022) • Shawcor Ltd. (2015-2021) • Industrial Alliance Insurance & Financial Services (2015-2019) • Groupe Jean Coutu (PJC), Inc. (2016-2018) | ||||

| 2024Proxy Statement | LyondellBasell | 16 |

| Virginia Kamsky, 70 American Non-Executive Director since 2022 INDEPENDENT Committees • C&TD Committee • HSE&S Committee |

Biography Ms. Kamsky is the Chair and Chief Executive Officer of Kamsky Associates, Inc., a firm she founded in 1980 and the first U.S. advisory firm approved to provide strategic advisory services in China. Ms. Kamsky began her career at Chase Manhattan Bank (now JPMorgan Chase Bank) and served in various capacities of increasing seniority, including as Second Vice President of Chase and head of Chase’s Corporate China Division. She has also served as a member of the US Secretary of the Navy Advisory Panel from 2009 to 2017 and as Chairman and CEO of China Institute in America from 2003 to 2013. She has been awarded the Navy Distinguished Civilian Service Award, the highest honorary award the Secretary of the Navy can confer on a civilian employee, selected as one of America’s 25 Top Asia Hands by Newsweek Magazine, and recognized as an Outstanding Public Company Director by the Financial Times. Ms. Kamsky received a B.A. from Princeton University. She brings to the Board a strong background in strategy and deep knowledge of the Asia-Pacific market. She also has extensive public company board experience, including at W.R. Grace & Co., Sealed Air Corporation, Olin Corporation, Tecumseh Products Company, Foamex International, Tate & Lyle PLC, Shorewood Packaging, Spectrum Brands, Kadem Sustainable Impact Corp. and, currently, at Dana Incorporated. | ||||

| Skills And Qualifications | ||||

• CEO Experience • Corporate Strategy • Risk Management • Industry Experience • Information Systems and Security | • Public Company Director • Capital Markets • HSE Experience • Corporate Finance • Technology and Innovation | • Corporate Governance • Mergers & Acquisitions • International Operations • Human Capital Management • Public Policy and Compliance | ||

Other Current Public Directorships • Dana Incorporated (since 2011) Former Public Directorships • Kadem Sustainable Impact Corp. (2021-2023) | ||||

| Bridget Karlin, 67 American Non-Executive Director Nominee INDEPENDENT Committees • Audit Committee • Nominating and Governance Committee |

Biography Ms. Karlin is the senior vice president of information technology for Kaiser Permanente, one of the nation’s largest not-for-profit health care systems, where she is responsible for the information technology, services and operations that power Kaiser Permanente’s business. Previously, she served as the global chief technology officer and vice president of IBM’s multi-billion-dollar Global Technology Services business from 2017 to 2021. Before joining IBM, she held senior leadership roles at Intel Corporation, as general manager of its Internet of Things division, and prior to that, as general manager of Intel’s Hybrid Cloud business. Additionally, she has served in executive positions at Union Bank, as managing director at Redleaf Venture Capital, and was president and co-founder of Thinque Systems, a pioneer in mobile software deployed in 43 countries. Ms. Karlin has extensive experience leading the strategy, development, and services for a hybrid, multi-cloud enterprise IT environment, leveraging artificial intelligence, automation, security, cloud, and open-source technologies to strengthen resiliency and ensure compliance, and modernizing offerings and capabilities across applications and infrastructure environments. With a career in the technology industry that spans over 30 years, including several executive positions at large international companies, she has considerable experience in advanced technology and enterprise-wide digital transformation. She currently serves on the Executive Board of the Consumer Technology Association, a non-profit organization that represents the U.S. consumer technology industry. Ms. Karlin is a graduate of the University of California and the Harvard Business School Executive Leadership Program, and is a recipient of the 2023 Digital Innovator Award, 2021 Technology Hall of Fame, the 2019 National Technology Humanitarian Award, the 2019 Women in Consumer Technology Legacy Award, the Industrial IoT 5G Innovators Award, the Malcolm Baldrige National Quality Award, and the Bell Labs Technology Innovator Award. | ||||

| Skills And Qualifications | ||||

• Information Systems and Security • Technology and Innovation • Corporate Strategy | • Corporate Governance • Risk Management • Public Company Director | • HSES Experience • Human Capital Management • Executive Management | ||

Other Current Public Directorships • Dana Incorporated (since 2019) | ||||

| 2024Proxy Statement | LyondellBasell | 17 |

| Albert Manifold, 61 Irish Non-Executive Director since 2019 INDEPENDENT Committees • C&TD Committee (Chair) • HSE&S Committee |

Biography Mr. Manifold has been the Group Chief Executive and a director of CRH plc, an international group of diversified building materials businesses supplying the construction industry, since 2014. Mr. Manifold joined CRH in 1998 and advanced to increasingly senior roles, including Finance Director of the Europe Materials Division, Group Development Director, Managing Director of Europe Materials, and Chief Operating Officer (2009 to 2014). Prior to joining CRH, Mr. Manifold was Chief Operating Officer of Allen McGuire & Partners, a private equity group. As a sitting chief executive officer with a background in other senior management roles, Mr. Manifold has acquired extensive leadership experience in competitive industries. With over 25 years in the building materials industry and 10 years of chief executive experience, Mr. Manifold brings significant knowledge of corporate finance, capital markets, strategic planning, acquisitions and divestitures, and international operations. Mr. Manifold is also a Fellow of the Institute of Certified Public Accountants in Ireland and received his M.B.A. and M.B.S. from Dublin City University. | ||||

| Skills And Qualifications | ||||

• Corporate Finance • International Operations • Corporate Accounting • HSES Experience • Human Capital Management | • Risk Management • Mergers & Acquisitions • CEO Experience • Corporate Governance • Public Policy and Compliance | • Capital Markets • Corporate Strategy • Capital Project Execution • Public Company Director | ||

Other Current Public Directorships • CRH plc (since 2009) | ||||

| Peter Vanacker, 58 Belgian-German Executive Director since 2022 |

| Biography | ||||

| Mr. Vanacker has served as our Chief Executive Officer since May 2022. Mr. Vanacker previously served as the President, Chief Executive Officer and Chair of the Executive Committee of Neste Corporation, a renewable products company, from 2018 to 2022. Prior to his role at Neste, he served as Chief Executive Officer and Managing Director of CABB Group GmbH, a fine chemicals producer, from 2015 to 2018 and as Chief Executive Officer and Managing Director of Treofan Group, a manufacturer of polypropylene films, from 2012 to 2015. He previously served as Executive Vice President and Member of the Executive Board of Covestro AG (formerly known as Bayer Material Science), a polymers and plastics producer, with responsibility for the global polyurethanes business and as Chief Marketing and Innovation Officer. He received his MSc in chemical engineering from Ghent University. Mr. Vanacker’s extensive experience in the oil and gas and chemicals industries, including chief executive officer and senior leadership experience, provide him with a deep understanding of the Company’s industry, operations, and feedstocks. In addition, he brings a strong understanding of circularity and sustainability issues, and extensive experience leading strategic transformations at large multinational companies. Mr. Vanacker also serves as a member of the Supervisory Board of Symrise AG, a chemicals company that is a major producer of flavors and fragrances. | ||||

| Skills And Qualifications | ||||

• Industry Experience • HSE Experience • CEO Experience • Corporate Finance • Risk Management | • Corporate Strategy • Capital Project Execution • International Operations • Mergers & Acquisitions • Technology and Innovation | • Corporate Governance • Public Company Director • Public Policy and Compliance • Human Capital Management | ||

Other Current Public Directorships • Symrise AG (since 2020) | ||||

| 2024Proxy Statement | LyondellBasell | 18 |

LyondellBasell Industries N.V.

PROXY STATEMENTOur governance guidelines and policies, including those listed below, are available on our website at www.LyondellBasell.com by clicking either (i) “Investors,” then “Corporate Governance” and “Board of Directors” or (ii) “Sustainability,” then “Reporting.”

| Corporate Governance Guidelines |  | Rules for the Board of Directors |

| Articles of Association |  | Committee Charters |

| Code of Conduct |  | Board Profile |

| Financial Code of Ethics |  | Tax Strategy Disclosure |

| Conflict Minerals Policy |  | Human Rights Policy |

| Human Trafficking and Anti-Slavery Statement |  | Supplier Code of Conduct |

| Health, Safety, Environment, Security Policy |  | Stakeholder Engagement Policy |

Who is soliciting my vote?

The SupervisoryOur Board annually reviews the independence of Directors is soliciting your vote atits members. In February 2024, the 2016 Annual General MeetingBoard affirmatively determined that all of LyondellBasell Industries shareholders.

Whyour non-executive directors and director nominees are these matters being submitted for voting?

In accordance with Dutch law andindependent under the rules and regulations of the New York Stock Exchange (the “NYSE”) and the U.S. Securities and Exchange Commission (the “SEC”), we are required to submit certain items for the approval of our shareholders. Under Dutch law, several matters that are within the authority of the board of directors under most U.S. state corporate laws require shareholder approval. Additionally, Dutch governance provisions require certain topics for discussion at the annual general meetings of shareholders that are not subject to a shareholder vote..

The adoption of our annual accounts, the discharge from liability of members of our Management and Supervisory Boards, the appointment of PwC to audit our Dutch annual accounts, the approval of dividends, and the authorization to repurchase shares all are items that we are required to submit to shareholders by reason of our being incorporated under Dutch law.

How does the Board recommend that I vote my shares?

The Supervisory Board recommends voting “FOR” all of the items presented in this proxy statement.

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Supervisory Board of Directors.

Who is entitled to vote?

You may vote if you are the record owner of LyondellBasell shares as of the close of business on April 13, 2016. Each share is entitled to one vote. As of March 3, 2016, we had 430,449,954 shares outstanding and entitled to vote.

How many votes must be present to hold the meeting?

Your shares are counted as present at the Annual Meeting if you attend the meeting and vote in person or if you properly return a proxy by Internet, telephone or mail. There are no quorum requirements under Dutch law. As a result, we may hold our meeting regardless of the number of shares that are present in person or by proxy at the meeting.

How many votes are needed to approve each of the proposals?

Pursuant to our Articles of Association, the nominations by the Supervisory Board of individuals to the Supervisory Board are binding on shareholders unless 2/3 of the votes cast, representing 50% of our issued share capital, vote against the nominees. This means that Supervisory Board nominees will be elected unless the votes against them constitute 2/3 of the votes representing 50% of our issued share capital.

All other proposals submitted, including the election of the members of the Management Board, require a majority of the votes cast “FOR” the proposal in order to be approved.

How do I vote?

You can vote eitherin person at the meeting orby proxy without attending the meeting.

To vote by proxy, you must vote over the internet, by telephone or by mail. Instructions for each method of voting are on the proxy card.

If you hold your LyondellBasell shares in a brokerage account (that is, you hold your shares in “street name”), your ability to vote by telephone or over the Internet depends on your broker’s voting process. Please follow the directions on your proxy card or voter instruction form carefully.

Even if you plan to attend the meeting, we encourage you to vote your shares by proxy. If you plan to vote in person at the Annual Meeting and you hold your LyondellBasell shares in street name, you must obtain a proxy from your broker and bring that proxy to the meeting.

Can I change my vote?

Yes. You can change or revoke your vote at any time before the polls close at the Annual Meeting. You can do this by:

Entering a new vote by telephone or over the Internet prior to 12:00 p.m. Eastern Time on May 10, 2016;

Signing another proxy card with a later date and returning it to us prior to the meeting;

Sending us a written document revoking your earlier proxy; or

Voting again in person at the meeting.

Who counts the votes?

We have hired Broadridge Financial Solutions, Inc. to count the votes represented by proxies and cast by ballot.

Will my shares be voted if I don’t provide my proxy and don’t attend the Annual Meeting?

If you do not provide a proxy or vote your shares held in your name, your shares will not be voted.

If you hold your shares in street name, your broker may be able to vote your shares for certain “routine” matters even if you do not provide the broker with voting instructions. We believe that, pursuant to NYSE rules, only the ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2016 is considered to be a routine matter. Therefore, without instructions from you, the broker may not vote on any proposals other than the ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2016.

What is a broker non-vote?

If a broker does not have discretion to vote shares held in street name on a particular proposal and does not receive instructions from the beneficial owner on how to vote those shares, the broker may return the proxy card without voting on that proposal. This is known as abroker non-vote.Broker non-votes will have no effect on the vote for any matter properly introduced at the meeting.

What if I return my proxy but don’t vote for some of the matters listed on my proxy card?

If you return a signed proxy card without indicating your vote, your shares will be voted “FOR” all matters for which you did not vote.

How are votes counted?

For all proposals other than the election of Supervisory Directors and Managing Directors, you may vote “FOR,” “AGAINST,” or “ABSTAIN.” For the election of Supervisory Directors and Managing Directors, you may vote “FOR,” “AGAINST,” or “WITHHOLD”. A vote to abstain or withhold does not count as a vote cast, and therefore will not have any effect on the outcome of matters.

Could other matters be decided at the Annual Meeting?

We are not aware of any other matters to be presented at the meeting. For matters to be properly brought before the Annual Meeting, they must be included in the meeting agenda. Discretionary authority to vote on other matters is included in the proxy designation.

Who can attend the meeting?

The Annual Meeting is open to all LyondellBasell shareholders. However, if you would like to attend the meeting, you must inform us in writing of your intention of doing so prior to May 4, 2016. The notice may be emailed to investors@lyondellbasell.com. Admittance of shareholders will be governed by Dutch law.

What is the cost of this proxy solicitation?

The Company will pay the cost of soliciting proxies. Our Supervisory Directors, officers and employees may solicit proxies by mail, by email, by telephone or in person for no additional compensation. We will also request banking institutions, brokerage firms, custodians, trustees, nominees and fiduciaries to forward solicitation materials to the beneficial owners of common stock held of record by those entities, and we will, upon the request of those record holders, reimburse reasonable forwarding expenses. We will pay the costs of preparing, printing, assembling and mailing the proxy materials used in the solicitation of proxies. In addition, we have retained Alliance Advisors, LLC to assist in the solicitation of proxies for a fee of $15,000, plus reasonable expenses.

Why did my household receive a single set of proxy materials?

SEC rules permit us to deliver a single copy of an annual report and proxy statement to any household at which two or more shareholders reside, if we believe the shareholders are members of the same family. This benefits both you and the Company, as it eliminates duplicate mailings that shareholders living at the same address receive and it reduces our printing and mailing costs. This rule applies to any annual reports, proxy statements, proxy statements combined with a prospectus or information statements. Each shareholder will continue to receive a separate proxy card or voting instruction card.

If you prefer to receive your own copy now or in future years, please request a duplicate set by phone at (800) 579-1639, through the Internet atwww.proxyvote.com, or by email atsendmaterial@proxyvote.com. If a broker or other nominee holds your shares, you may continue to receive some duplicate mailings. Certain brokers will eliminate duplicate account mailings by allowing shareholders to consent to such elimination, or through implied consent if a shareholder does not request continuation of duplicate mailings. Since not all brokers and nominees may offer shareholders the opportunity this year to eliminate duplicate mailings, you may need to contact your broker or nominee directly to discontinue duplicate mailings to your household.

SUPERVISORY BOARD OF DIRECTORS

The Nominating & Governance Committee and our Supervisory Board review the Company’s governance structure to take into account changes in Dutch law, SEC and NYSE rules, as well as current best practices.

Our Corporate Governance Guidelines and our Code of Conduct are posted on the Company’s Internet site under the “Corporate Governance” caption of the “Investor Relations” tab and are available in print upon request. The Guidelines address the following matters, among others: Supervisory Director qualifications, Supervisory Director responsibilities, Supervisory Board committees, Supervisory Director access to officers, employees and independent advisors, Supervisory Director compensation, Supervisory Board performance evaluations, Supervisory Director orientation and continuing education, and Chief Executive Officer evaluation and succession planning.

Our Supervisory Board is divided into three classes, each consisting of one-third of the total number of the members of the Supervisory Board. Messrs. Aigrain, Benet and Smith and Ms. Dicciani are each Class III Supervisory Directors whose terms expire at the Annual Meeting. Mr. Benet was appointed as a Class III director by our Supervisory Board in June 2015 upon a nomination by Access Industries, which owns more than 18% of our shares, pursuant to a Nomination Agreement between the company and Access. Our Supervisory Board has nominated each of Messrs. Aigrain, Benet and Smith and Ms. Dicciani for election or re-election by shareholders, as applicable.

Communications with the Supervisory Board and Shareholder Proposals

The Supervisory Board maintains a process for shareholders and interested parties to communicate with the Board. Shareholders and interested parties may write or call our Supervisory Board by contacting our Corporate Secretary, as provided below:

Communications are distributed to the Supervisory Board or to any individual Supervisory Director or Supervisory Directors, as appropriate, depending on the facts and circumstances outlined in the communication. In that regard, certain items that are unrelated to the duties and responsibilities of the Supervisory Board are excluded, such as: business solicitations or advertisements; junk mail and mass mailings; new product suggestions; product complaints; product inquiries; resumes and other forms of job inquiries; spam; and surveys. In addition, material that is unduly hostile, threatening, illegal or similarly unsuitable will be excluded. Any communication that is filtered out is made available to any Supervisory Director upon request.

Under our Articles of Association, as amended, one or more shareholders representing solely or jointly at least 1% of our issued share capital or whose shares represent a value of €50 million or more can request the Supervisory Board to place a matter on the agenda for an annual meeting of shareholders, provided that such request is received by the Company at least 60 days before the date of the meeting. Additionally, pursuant to shareholder proposal rules issued by the SEC, if a shareholder wishes to propose a matter for inclusion in our proxy materials for consideration at our 2017 annual meeting of shareholders, subject to our Articles of Association, Dutch law and certain shareholder requirements set forth in the rules of the SEC, the proposal should be mailed by certified mail return receipt requested to the Corporate Secretary at the address set forth above and must be received by the Corporate Secretary on or before November 28, 2016.

We have a two-tiered board, a common structure for Dutch public companies. The two boards include a Management Board, responsible for the management of the Company, and a Supervisory Board, responsible for the general oversight of the Management Board. Only executive officers of the Company may serve on the Management Board and only non-employees of the Company may serve on the Supervisory Board. Our Articles of Association provide that our Chief Executive Officer (“CEO”) shall serve as the Chairman of the Management Board. The following individuals are the current members of our Management Board:

Bhavesh V. (Bob) Patel, CEO and Chairman of the Management Board;

Kevin W. Brown, Executive Vice President – Manufacturing & Refining; and

Jeffrey A. Kaplan, Executive Vice President and Chief Legal Officer.

At the Annual Meeting, we are requesting shareholders to elect each of the following executive officers as members of our Management Board:

Thomas Aebischer, Executive Vice President and Chief Financial Officer (“CFO”);

Daniel M. Coombs, Executive Vice President – Global Olefins & Polyolefins and Technology; and

James D. Guilfoyle, Senior Vice President – Global Intermediates & Derivatives.

More information about the Management Board and Mr. Aebischer, Mr. Coombs and Mr. Guilfoyle may be found under “Election of Managing Directors” on page 21 of this proxy statement.

The principal responsibility of the Management Board is the overall management of the Company. This means, among other things, that the Management Board is responsible for implementing LyondellBasell’s aims and strategy, managing the Company’s associated risk profile, overseeing the operation of the business and addressing corporate responsibility issues relevant to the enterprise.

The principal responsibility of the Supervisory Board is overseeing the policies of the Management Board and the general course of business and related business enterprises. Robert G. Gwin is the Chairman of the Supervisory Board.

Our two-tier board structure allows our executive officers to focus on managing our day-to-day business, including achieving our aims, strategy and risk profile, and results of operations. It also allows Mr. Gwin, as non-executive Chairman of the Supervisory Board, to lead the Supervisory Board in its fundamental role of supervising the policies of the Management Board. We believe this separation of responsibilities is appropriate for LyondellBasell because of the scope and complexity of the Company’s operations. We also believe the separation of CEO and Chairman of the Supervisory Board is a corporate governance best practice.

While the Company’s Management Board is responsible for the risk profile of the Company and managing the day-to-day risks to the Company, the Supervisory Board has broad oversight as it relates to risk management. In this oversight role, the Supervisory Board is responsible for satisfying itself that the risk management processes designed and implemented by the Company’s management are functioning and that necessary steps are taken to foster a culture of risk-adjusted decision-making throughout the organization. The Company believes that its leadership structure is conducive to sound risk management, and that the Supervisory Board’s involvement is appropriate to ensure effective oversight.

The primary means by which our Supervisory Board oversees our risk management structures and policies is through its regular communications with management. At each Supervisory Board meeting, executive officers

are asked to report to the Supervisory Board and, when appropriate, specific committees. Additionally, other members of management and employees periodically attend meetings and present information. One purpose of these presentations is to provide direct communication between members of the Supervisory Board and members of management. The presentations provide the Supervisory Board with the information necessary to understand the risk profile of the Company, including information regarding the specific risk environment, exposures affecting the Company’s operations and the Company’s plans to address such risks. In addition to information regarding general updates to the Company’s operational and financial condition, members of management report to the Supervisory Board about the Company’s outlook and forecasts, and any impediments to meeting those or its pre-defined strategies generally. These direct communications allow the Supervisory Board to assess the evaluation and management of the Company’s day-to-day risks.

In carrying out its oversight responsibility, the Supervisory Board has delegated to individual Supervisory Board committees certain elements of its oversight function.

The Audit Committee provides oversight of the integrity of the Company’s financial statements; the Company’s independent accountants’ qualifications and independence; the performance of the Company’s internal audit function, independent accountants and the Company’s compliance program; and the Company’s system of disclosure and internal controls.

The Compensation Committee monitors the Company’s compensation structure and assesses whether any excessive risks are created by our compensation programs.

The Nominating & Governance Committee reviews policies and practices in the areas of corporate governance; considers the overall relationship of the Supervisory Board to the Company’s management; and develops, reviews and recommends governance guidelines applicable to the Company.

The Health, Safety and Environmental (“HSE”) Committee reviews and monitors compliance with health, safety and environmental matters affecting the Company and provides oversight of the Company’s technology. Our HSE Committee discusses the Company’s HSE and Operational Excellence programs, reviewing audits of operations; safety and environmental incidents and statistics; as well as action plans and initiatives to continuously improve HSE results.

The Company has an enterprise risk management function, with a group of employees dedicated to enterprise-wide risk management activities. The Management Board is responsible for overseeing the risk management programs of the Company generally, including approving risk tolerances, evaluating whether they are aligned with the Company’s strategic goals, and defining the overall risk profile of the Company. The Management Board has delegated to a Risk Management Committee the authorization to review and approve transactions that are in furtherance of the strategies as approved by the Management Board. The standing members of the Risk Management Committee include the Company’s CEO, CFO and Chief Legal Officer. Through a variety of policies and procedures, business leaders are required to identify, monitor, mitigate and report on risks under the supervision of the Management Board, which requires risk management plans from each business segment.

The results of the risk management processes and updates on materials risks are reported to the Supervisory Board and its Committees. In addition, the Audit Committee is responsible for ensuring that an effective risk assessment process is in place, and reports are made to the Audit Committee in accordance with NYSE requirements.

Independence of Supervisory Board Members

The Supervisory Board has determined that all twelve Supervisory Directors are independent in accordance with the NYSE listing standards.

To assist in determining independence, the Supervisory Board adopted categorical standards of Supervisory Director independence whichthat meet, orand in some instances exceed, the requirements of the NYSE. TheseIn order to qualify as independent under our categorical standards, specify certain relationships thata director must be avoideddetermined to allow forhave no material relationship with LYB other than as a finding of independence.director. The categorical standards our Supervisory Board uses in determininginclude strict guidelines for non-executive directors and their immediate families regarding employment or affiliation with LYB and its independent registered public accounting firm. Our categorical independence standards are included in our Corporate Governance Guidelines, which can be found on our website at www.lyb.com.Guidelines.

In July 2015, the Supervisory Board amended the categorical standards to remove two specific relationships that previously barred a finding of independence. These two relationships include: any director who (i) holds at least ten percent of the shares in the Company (including shares held by natural persons or legal entities which cooperate with him under an express or tacit, oral or written agreement); and/or (ii) is a member of the management board or supervisory board, or is a representative in some other way, of a legal entity which holds at least ten percent of the shares in the Company, unless such entity is a member of the same group as the Company. These relationships originally were included in the categorical standards to be consistent with the Dutch Corporate Governance Code (compliance with which is in accordance with the “apply-or-explain” principle and is applicable to the Company as a Dutch incorporated entity) and because of historical relationships certain large shareholders had with the Company’s predecessor before it became a listed Company. The Supervisory Board deleted these provisions after determining, consistent with the commentary to the NYSE’s listing standards, that share ownership, alone, is no longer an appropriate bar to a finding of independence. For more information on the Company’s application of the Dutch Corporate Governance Code, see “Dutch Corporate Governance Code.”

The Supervisory Board has determined that there are no relationships or transactions that prohibit any of our non-executive directors or nominees from being deemed independent under the categorical standards as amended,and that would prohibit anyeach of the Supervisory Directors from being deemedour non-executive directors and nominees is independent. In addition to the relationships and transactions that would bar an independence finding under the categorical standards, the Supervisory Board considered all other known relationships and transactions in making its determination. Transactions and relationships considered included:

Company subsidiaries’ purchases of natural gas liquids from a subsidiary of Anadarko Petroleum, where Mr. Gwin serves as Executive Vice President and CFO;

Company subsidiaries’ purchases of utilities from a subsidiary of CenterPoint Energy, where Mr. Carroll serves as chairman;

Company subsidiaries’ engagement of the employee search and recruitment services of Michael Page International, where Mr. Buchanan served as Chairman until the end of 2015;

Company subsidiaries’ purchases of insurance coverage from a subsidiary of MassMutual Financial Group, where Ms. Goren is a director;

Mr. Benet’s position as CEO of Access Industries, the Company’s largest shareholder;

Company subsidiaries’ purchases of industrial gases,determination, including hydrogen and nitrogen, from, and sales of crude hydrogen to, Praxair, where Ms. Dicciani is a director;

Mr. Cooper’s position as CEO of Warner Music, a subsidiary of Access Industries;

Mr. Buchanan’s position as Non-Executive Chairman of Access Industries’ Investment Committee; and

Company subsidiaries’ purchases of measurement products from a subsidiary of FMC Technologies, where Ms. Farley is a director.

those referenced under “Related Party Transactions” on page 88. In determining that none of theseno known transactions or relationships affectedaffect the independence of any of the interested Supervisory Directors,non-executive directors, the Supervisory Board considered the naturethat all of the transactions and relationships. All of theidentified transactions are ordinary course and none of the dollar amounts involved waswere material to the Company or the relevant counterparty.

| 2024Proxy Statement | LyondellBasell | 19 |

Jacques Aigrain has led our Board as its independent Chair since 2018. The Chair’s responsibilities include:

| • | Leading Board meetings and executive sessions |

| • | Reviewing and approving Board meeting agendas and schedules, and ensuring there is sufficient time for discussion of topics |

| • | Convening additional Board meetings, as needed |

| • | Facilitating information flow and communication among directors |

| • | Serving as a liaison between the independent directors and the CEO and other members of management |

| • | Together with the C&TD Committee, setting annual and long-term performance goals for the CEO and evaluating his performance |

| • | Presiding at general meetings of shareholders |

| • | Meeting or engaging with shareholders, as appropriate |

| • | Supporting the Company’s strategic growth initiatives |

The Board regularly reviews LYB’s leadership structure and the responsibilities of its Chair, and may from time to time delegate additional duties to the role.

Under Dutch law, only a non-executive director may serve as Chair of our Board. Our Board believes that the separation of the positions of Chair and Chief Executive Officer that results from this governance structure promotes strong Board governance, independence, and oversight. The separation of the two roles additionally allows Mr. Aigrain to focus on managing Board matters while our CEO, Mr. Vanacker, focuses on managing our business.

Executive sessions of our independent directors, with no members of management present, take place at every regularly scheduled Board and committee meeting. During executive sessions, independent directors have an opportunity to meet with the Board’s outside consultants and independent accountants and review and discuss any matters they deem appropriate, such as the performance of the Chief Executive Officer and other members of management and the criteria against which performance is evaluated, including the impact of performance on compensation matters. Mr. Aigrain leads these executive sessions of the Board.

Our Board and its committees evaluate their own effectiveness by participating in a robust annual self-assessment process overseen by the Nominating and Governance Committee. Each year, directors respond to survey questions soliciting information used to improve the effectiveness of the Board and its committees and individual directors. The Nominating and Governance Committee periodically engages independent outside consultants, including most recently in 2020, to conduct interviews with the Board and facilitate the evaluation process. The Nominating and Governance Committee has engaged an independent outside consultant to begin work in 2024 in order to refresh and bring an outside perspective to the evaluation process.

| 2024Proxy Statement | LyondellBasell | 20 |

For 2023, the Board conducted its evaluation process as described below.

| 1 | ||||

Development and Approval of Evaluation Process and Topics | In September 2023, the Nominating and Governance Committee discussed and approved the overall process and timeline for the 2023 evaluation cycle and identified an independent consultant for the 2024 evaluation cycle. The Nominating and Governance Committee approved the topics and questions for distribution to the individual Board members. Questions were largely consistent with those used in prior cycles, with the addition of questions to cover director expertise and succession. As in prior cycles, the Committee approved an individual evaluation process for the Chair, to be facilitated through survey questions specific to his role. | |||

| 2 | ||||

Distribution and Completion of Surveys | Board members provided responses to the surveys, including separate assessments for each Board committee and for the Chair. In parallel, senior executives provided their views of Board effectiveness and interactions with management through confidential survey responses provided to the Corporate Secretary. Key areas covered in the Board and committee surveys include membership; responsibilities; functionality; meetings; strategy; senior management (including succession planning); focus on performance; ensuring financial robustness; monitoring risk; compliance; and building corporate reputation. Committee members are also asked to consider whether each committee is functioning in compliance with its charter and keeping the Board adequately informed, and to review the committee’s member skill sets and leadership. Survey questions for the individual Chair assessment focused on effective management of meetings and facilitation of constructive relationships and communication among Board members and with management. | |||

| 3 | ||||